Not known Details About Clark Wealth Partners

Wiki Article

Top Guidelines Of Clark Wealth Partners

Table of ContentsNot known Details About Clark Wealth Partners The Buzz on Clark Wealth PartnersClark Wealth Partners - QuestionsWhat Does Clark Wealth Partners Mean?See This Report about Clark Wealth PartnersSome Known Incorrect Statements About Clark Wealth Partners Not known Incorrect Statements About Clark Wealth Partners The 6-Second Trick For Clark Wealth Partners

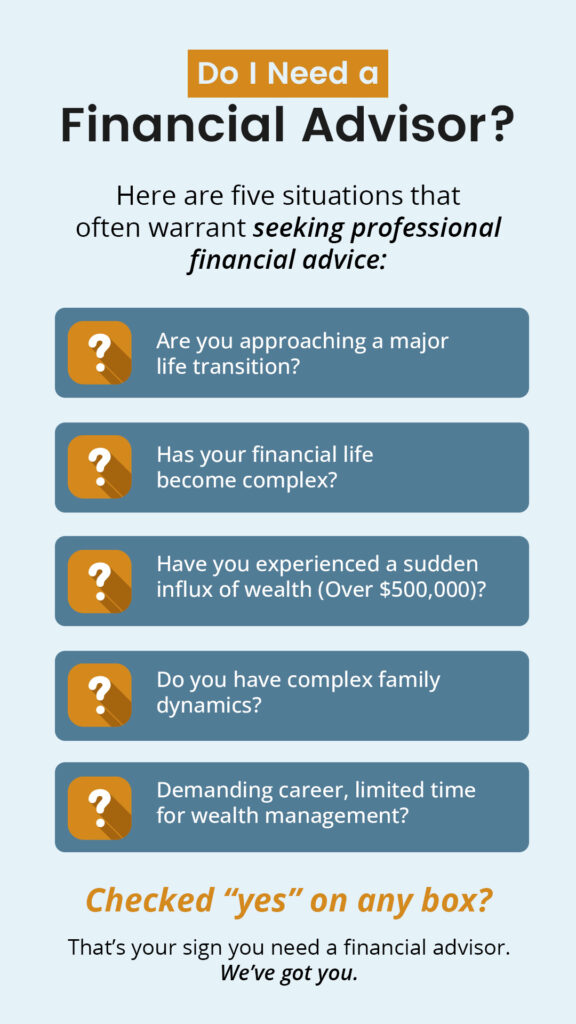

Common reasons to think about a financial advisor are: If your economic situation has become more complex, or you do not have confidence in your money-managing skills. Conserving or browsing major life events like marriage, separation, children, inheritance, or work modification that might substantially impact your monetary situation. Browsing the shift from saving for retirement to maintaining wealth during retirement and how to create a strong retired life revenue strategy.New innovation has caused more extensive automated financial devices, like robo-advisors. It's up to you to check out and figure out the appropriate fit - https://www.bark.com/en/us/company/clark-wealth-partners/KNA896/. Ultimately, a good financial consultant needs to be as mindful of your financial investments as they are with their own, avoiding extreme costs, conserving cash on taxes, and being as clear as feasible about your gains and losses

Clark Wealth Partners Can Be Fun For Anyone

Making a payment on item recommendations doesn't necessarily indicate your fee-based expert functions against your benefits. They may be more inclined to advise products and services on which they gain a commission, which might or may not be in your best passion. A fiduciary is legally bound to place their client's interests.This common permits them to make referrals for investments and services as long as they fit their client's objectives, threat resistance, and economic circumstance. On the other hand, fiduciary advisors are legally obliged to act in their customer's ideal interest rather than their own.

The Main Principles Of Clark Wealth Partners

ExperienceTessa reported on all things spending deep-diving into intricate economic topics, losing light on lesser-known investment opportunities, and discovering methods readers can work the system to their benefit. As an individual money professional in her 20s, Tessa is really aware of the effects time and uncertainty carry your financial investment choices.

It was a targeted advertisement, and it worked. Find out more Check out much less.

5 Easy Facts About Clark Wealth Partners Shown

There's no solitary route to becoming one, with some individuals starting in banking or insurance coverage, while others begin in accounting. 1Most economic organizers start with a bachelor's level in financing, economics, accountancy, service, or a relevant subject. A four-year level gives a strong structure for jobs in financial investments, budgeting, and customer service.

Unknown Facts About Clark Wealth Partners

Typical examples consist of the FINRA Series 7 and Series 65 tests for securities, or a state-issued insurance coverage certificate for selling life or medical insurance. While credentials might not be lawfully needed for all planning duties, companies and clients often view them as a criteria of professionalism. We take a look at optional qualifications in the next section.A lot of monetary planners have 1-3 years of experience and experience with financial products, conformity requirements, and direct customer communication. A strong instructional background is crucial, yet experience demonstrates the capacity to use concept in real-world setups. Some programs integrate both, enabling you to complete coursework while making supervised hours with teaching fellowships and practicums.

Everything about Clark Wealth Partners

Very early years can bring lengthy hours, pressure to build a customer base, and the need to consistently show your knowledge. Financial planners take pleasure in the possibility to work very closely with clients, overview important life decisions, and commonly achieve versatility in schedules or self-employment.

They invested less time on the client-facing side of the industry. Almost all economic supervisors hold a bachelor's degree, and numerous have an MBA or similar graduate degree.

Facts About Clark Wealth Partners Revealed

Optional accreditations, such as the CFP, generally need extra coursework and testing, which can extend the timeline by a couple of years. According to the Bureau of Labor Data, personal look at more info economic experts gain a mean yearly yearly salary of $102,140, with top earners gaining over $239,000.In other provinces, there are regulations that need them to satisfy specific requirements to utilize the economic advisor or monetary organizer titles. For monetary organizers, there are 3 common designations: Certified, Personal and Registered Financial Planner.

Clark Wealth Partners - The Facts

Those on income might have a reward to advertise the services and products their employers provide. Where to find an economic advisor will certainly rely on the sort of recommendations you require. These establishments have staff that may aid you understand and purchase specific sorts of investments. For instance, term deposits, ensured financial investment certificates (GICs) and common funds.Report this wiki page